GRESB - Global Real Estate Sustainability Benchmark

GRESB (Global Real Estate Sustainability Benchmark) is the leading assessment system for measuring and evaluating the sustainability performance of entire real estate portfolios according to ESG criteria.

GRESB provides actionable and transparent environmental, social and governance (ESG) data to the financial markets. It independently collects, validates, assesses and benchmarks ESG data to provide business intelligence, engagement tools and regulatory reporting solutions. The resulting benchmark results are based on a rigorous, consistent methodology to enable investors and managers to assess the ESG performance of a given fund.

About GRESB

GRESB B.V. was founded in 2009 by a group of real estate fund owners. The GRESB assessment should facilitate access to reliable and, above all, comparable data on the ESG performance of potential investments. It is a tool designed to help evaluate and compare the sustainability of entire real estate portfolios and holdings according to ESG criteria.

ESG stands for environment, social and governance and refers to environmental, social and administrative performance.

The assessment creates benchmarks for these areas that enable cross-sector comparisons.

GRESB thus creates points of reference and transparency in the sustainable construction, real estate and investment sectors.

After completing the assessment, participants have access to a benchmark report and a scorecard with an evaluation of the individual data.

GRESB is also part of the CRREM project (Carbon Risk Real Estate Monitor).

The aim of the project is to identify transparent and science-based decarbonization pathways for the real estate sector in order to limit the global rise in temperature and achieve the goals set out in the Paris Climate Agreement.

GRESB benchmarks

Each year GRESB provides the following ESG benchmarks:

- Real Estate Benchmark

- Real Estate Development Benchmark

- Infrastructure Fund Benchmark

- Infrastructure Asset Benchmark

These benchmarks are created by evaluating the data submitted by all participants and show the individual participants where they stand in comparison to the average of their competitors.

How does the GRESB rating work?

For the GRESB rating, the data of all properties in a portfolio or portfolio are compiled. Technical data, usage data, etc. are collected in a questionnaire that also includes users and tenants.

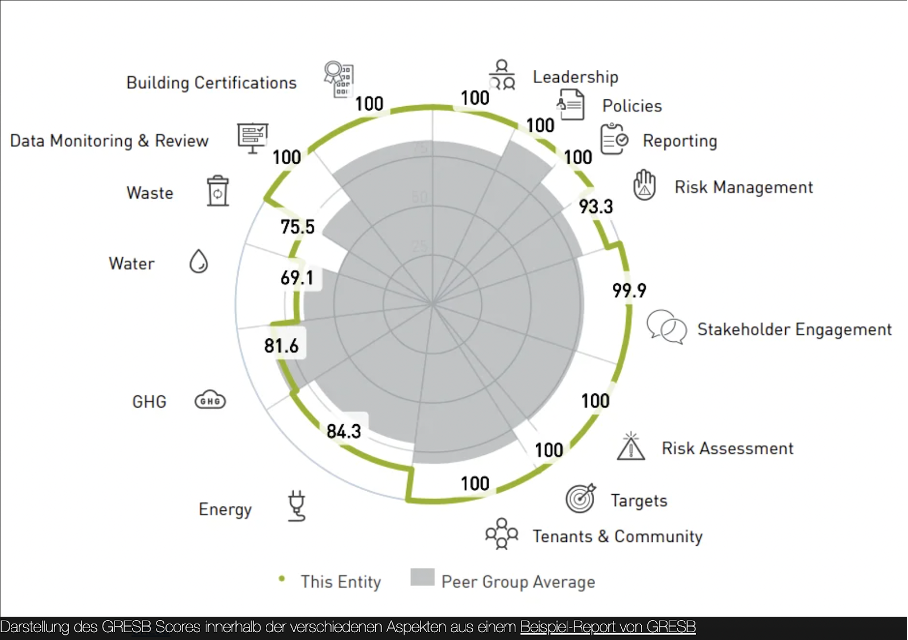

The data is evaluated in the above-mentioned categories and given a score between zero and 100.

The performance of the portfolio is presented in a pie chart – including average values for the peer group.

The level of the GRESB score also determines the rating.

For the GRESB Real Estate Assessment, the fulfillment of the criteria from the areas of management and performance is assessed, while for the GRESB Real Estate Development Assessment the areas of management and development are assessed.

Between 1 and 5 stars are awarded for fulfillment of the criteria.

The “Green Star” is only awarded as part of the Real Estate Assessments if more than 50% of the points are achieved in both categories to be assessed.

Participants in the GRESB Assessment Program receive a GRESB Scorecard and an individual GRESB Benchmark Report at the end of the assessment.

The scorecard contains the GRESB score, the GRESB rating and a summarized analysis of the performance compared to the competitors.

The Benchmark Report contains an analysis of ESG performance broken down by criteria and also comparative values for competitors.

The detailed analysis makes it possible to identify the areas in which the participants perform below or above average.

Based on the report, participants can therefore make informed decisions on how to improve their ESG performance.

What distinguishes GRESB from DGNB, LEED and other certification systems?

While building certification systems such as DGNB or LEED look at the performance potential of individual properties, the GRESB assessment compiles and evaluates the sustainability performance of all individual properties at portfolio level.

We will be happy to advise you personally on further questions relating to sustainable building.

Phone +49 711 62049-340

Email info@hoinka.com