GRESB Assessment

We are your reliable partner for all questions related to the GRESB assessment and improving your GRESB score by implementing sustainable strategies.

Kontaktieren Sie unsGRESB creates reliable ESG benchmarks for the real estate industry

The shift towards greater sustainability can also be clearly felt in the construction industry. Real estate should be future-proof, meet high efficiency requirements, exceed new legal regulations in the best case and at the same time be cost-efficient and create a high level of comfort for users. Various certification systems offer guidance and recommendations for building owners and project planners. But if you want to be fit for the future, you also need to keep an eye on potential investors. The EU Taxonomy and Disclosure Regulation, which has been in force since 2021, has also brought sustainability into focus for investors. The GRESB Real Estate Assessment facilitates access to reliable data on the sustainability performance of potential investments in the real estate sector.

What is GRESB?

GRESB (Global Real Estate Sustainability Benchmark) is the leading assessment system for measuring and evaluating the sustainability performance of entire real estate portfolios according to ESG criteria.

GRESB B.V. was founded in 2009 by a group of real estate fund owners. The GRESB Assessment was designed to facilitate access to reliable and, above all, comparable data on the ESG performance of potential investments. It is a tool designed to help evaluate and compare the sustainability of entire real estate portfolios and holdings according to ESG criteria. ESG stands for environment, social and governance and refers to environmental, social and administrative performance. The assessment creates benchmarks for these areas that enable cross-sector comparisons. GRESB thus creates points of reference and transparency in the sustainable construction, real estate and investment sectors. After completing the assessment, participants have access to a benchmark report and a scorecard with an evaluation of the individual data.

GRESB is also part of the CRREM project (Carbon Risk Real Estate Monitor). Ziel des Projekts ist es, transparente und wissenschaftsbasierte Wege zur Dekarbonisierung für die Immobilienbranche aufzuzeigen, um den globalen Temperaturanstieg einzugrenzen und die festgelegten Ziele des Pariser Klimaabkommens zu erreichen.

GRESB benchmarks

Each year GRESB provides the following ESG benchmarks:

- Real Estate Benchmark

- Real Estate Development Benchmark

- Infrastructure Fund Benchmark

- Infrastructure Asset Benchmark

These benchmarks are created by evaluating the data submitted by all participants and show the individual participants where they stand in comparison to the average of their competitors.

Welche Kriterien werden beim GRESB Assessment bewertet?

Die Bewertung für den GRESB Real Estate Benchmark Report erfolgt in den Kategorien Management, Performance und Development. Die einzelnen Kategorien decken die ESG-Kriterien in unterschiedlichem Maße ab:

| Environment | Social | Governance | |

| Management | 0 % | 35 % | 65 % |

| Performance | 89 % | 11 % | 0 % |

| Development | 73 % | 21 % | 6 % |

In der Kategorie Management können insgesamt 30 Punkte erreicht werden, In den Kategorien Performance und Development jeweils 70. Innerhalb der Kategorien wird die Performance in verschiedenen Aspekten bewertet und miteinander in Beziehung gesetzt. Folgende Punkte werden im Rahmen der Bewertung unter anderem betrachtet:

- Management: Gibt es eine Nachhaltigkeitsstrategie? Wird die Nachhaltigkeitsstrategie transparent kommuniziert? Wie gut ist die Zusammenarbeit von Stakeholdern (Mietern, Zulieferer, Mitarbeiter, etc.)?

- Performance: Werden Maßnahmen ergriffen, um Risiken im Zusammenhang mit Korruption, Bestechung, Klimawandel und neuen Umweltregulierungen zu verringern oder abzuwenden? Wird der Verbrauch von Ressourcen und die Müllproduktion überwacht? Gibt es Zertifikate zur Nachhaltigkeit von einzelnen Objekten, die von unabhängigen Dritten erstellt wurden?

- Development: Wie entwickelt sich die Performance des Portfolios?

| Category | Aspect | Points | Share category | Share

Overall rating |

| Management | Leadership | 7 | 23 % | 7 % |

| Policies | 4.5 | 15 % | 5 % | |

| Reporting | 3.5 | 12 % | 4 % | |

| Risk Management | 5 | 17 % | 5 % | |

| Stakeholder engagement | 10 | 33 % | 10 % | |

| Total | 30 | 100 % | 30 % | |

| Performance | Risk Assessment | 9 | 13 % | 9 % |

| Targets | 2 | 3 % | 2 % | |

| Tenants & Community | 11 | 16 % | 11 % | |

| Energy | 14 | 20 % | 14 % | |

| GHG | 7 | 10 % | 7 % | |

| Water | 7 | 9,5 % | 7 % | |

| Waste | 4 | 5.5 % | 4 % | |

| Data Monitoring & Review | 5.5 | 8 % | 6 % | |

| Building Certifications | 10.5 | 15 % | 11 % | |

| Total | 70 | 100 % | 70 % | |

| Development | ESG Requirements | 12 | 17 % | 12 % |

| Materials | 6 | 9 % | 6 % | |

| Building Certifications | 13 | 19 % | 13 % | |

| Energy | 14 | 20 % | 14 % | |

| Water | 5 | 7 % | 5 % | |

| Waste | 5 | 7 % | 5 % | |

| Stakeholder engagement | 15 | 21 % | 15 % | |

| Total | 70 | 100 % | 70 % |

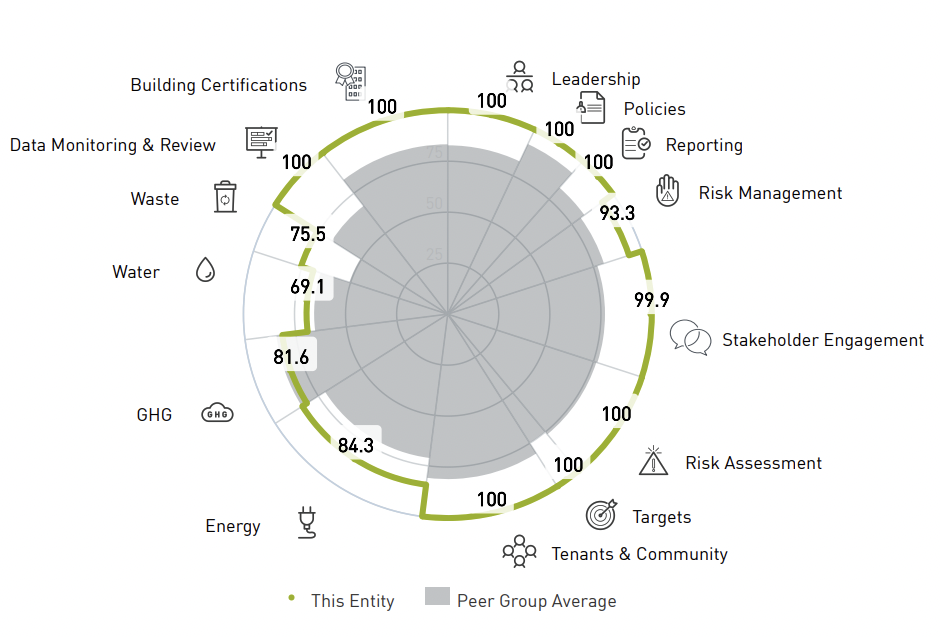

Auch die Leistung in den Unterkategorien wird mit einem Wert zwischen null und 100 dargestellt. Das Gesamtergebnis ist der GRESB-Score. Zur Einordnung werden die Ergebnisse mit dem Durchschnitt in der Peer Group verglichen.

Der Bewertungsrahmen orientiert sich an den Themen, die Investoren und die Branche selbst als die wesentlichen Herausforderungen in Punkto Investments und nachhaltige Immobilien sehen. Zudem richtet sich die Bewertung nach internationalen Berichtsrahmenwerken, wie GRI, PRI, SASB, DJSI, Empfehlungen der TCFD, dem Pariser Klimaabkommen, den Sustainable Development Goals der UN und länderspezifischen Offenlegungsrichtlinien und Bestimmungen.

How does the GRESB rating work?

For the GRESB rating, the data of all properties in a portfolio or portfolio are compiled. Technical data, usage data, etc. are collected in a questionnaire that also includes users and tenants. The data is evaluated in the above categories and given a score between zero and 100. The performance of the portfolio is shown in a pie chart – including the average values of the peer group. The level of the GRESB score also determines the rating.

For the GRESB Real Estate Assessment, the fulfillment of the criteria from the areas of management and performance is evaluated, for the GRESB Real Estate Development Assessment the areas of management and development. Between 1 and 5 stars are awarded for fulfillment of the criteria. The “Green Star” is only awarded as part of the Real Estate Assessments if more than 50% of the points are achieved in both categories to be assessed.

Participants in the GRESB Assessment Program receive a GRESB Scorecard and an individual GRESB Benchmark Report at the end of the assessment. The scorecard contains the GRESB score, the GRESB rating and a summarized analysis of performance in comparison to competitors. The benchmark report contains an analysis of ESG performance broken down by criteria as well as comparative figures for competitors. The detailed analysis makes it possible to identify the areas in which the participants perform below or above average. Based on the report, participants can therefore make informed decisions to improve their ESG performance.

What distinguishes GRESB from DGNB, LEED and other certification systems?

Während bei Gebäudezertifizierungssystemen wie DGNB oder LEED das Performancepotential einzelner Immobilien betrachtet wird, wird mit dem GRESB Assessment die Nachhaltigkeitsperformance aller einzelnen Immobilien auf Portfolioebene zusammengetragen und ausgewertet.

We will be happy to advise you personally on further questions relating to sustainable building.

Phone +49 711 62049-340

Email info@hoinka.com